Real estate bonds Your way to a regular income.

8,5%p.a.

Investment in real estate projects with bonds

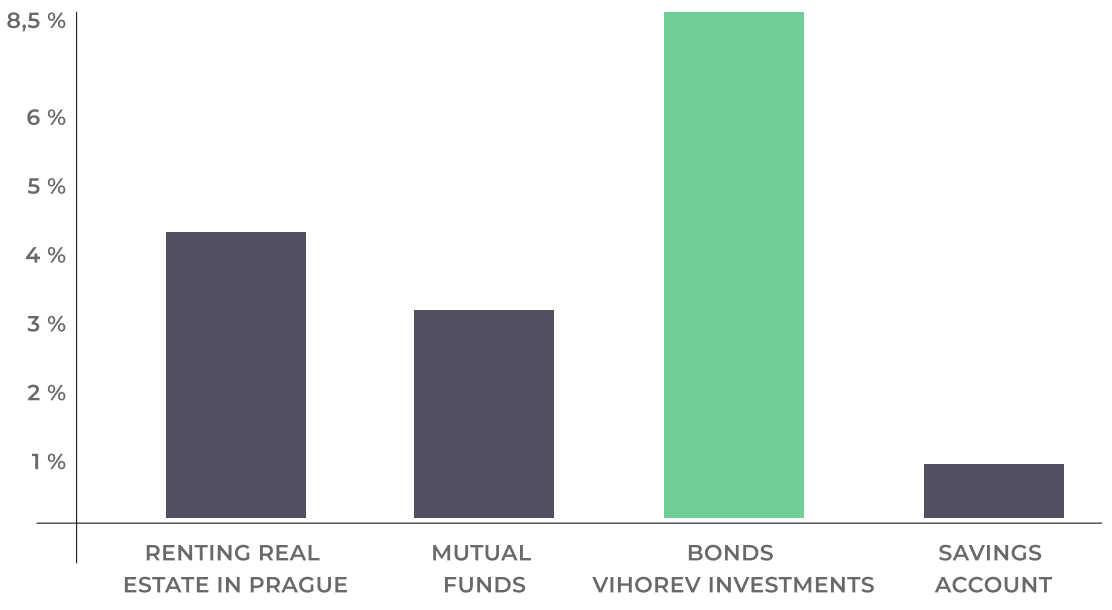

Investment instrument yield comparison chart

Real Estate bonds

Real Estate prices rise continuously

There are real Real Estate projects in premium localities behind the bonds.

Investment rental housing!

Yield 8,5% p.a. with quarterly payout

Investment from 20 thousand CZK

No commitments

Investment opportunities

Completed

Completed

- 8 090 m² Total usable area

- Říčany, Prague-East Location

- 2Q 2024 Project finish date

- over 650 mil. CZK Total value of the investment

HONEST Říčany

This is one of the flagship projects in our current portfolio. Reconstruction of Alfa Tower in Říčany into a modern multifunctional building.

Completed

Completed

- over 1 000 m² Total usable area

- Prague 8, Karlín Location

- 1Q 2024 Project finish date

- 100 mil. CZK Total value of the investment

HONEST Karlín

Project of total revitalization and extension of the building in Prvního pluku Street. The building will serve as modern apartment housing.

Vihorev Group We create investment opportunities in real estate

We are a development and investment company. Our portfolio is built on the solid foundations of the investment rental housing market. We have a professional team with more than ten years of experience in the Real Estate market.

- 10+ years of Experience

- 17 286 m² in the Real Estate portfolio

- +64 milions of marketable assets

We are professionals

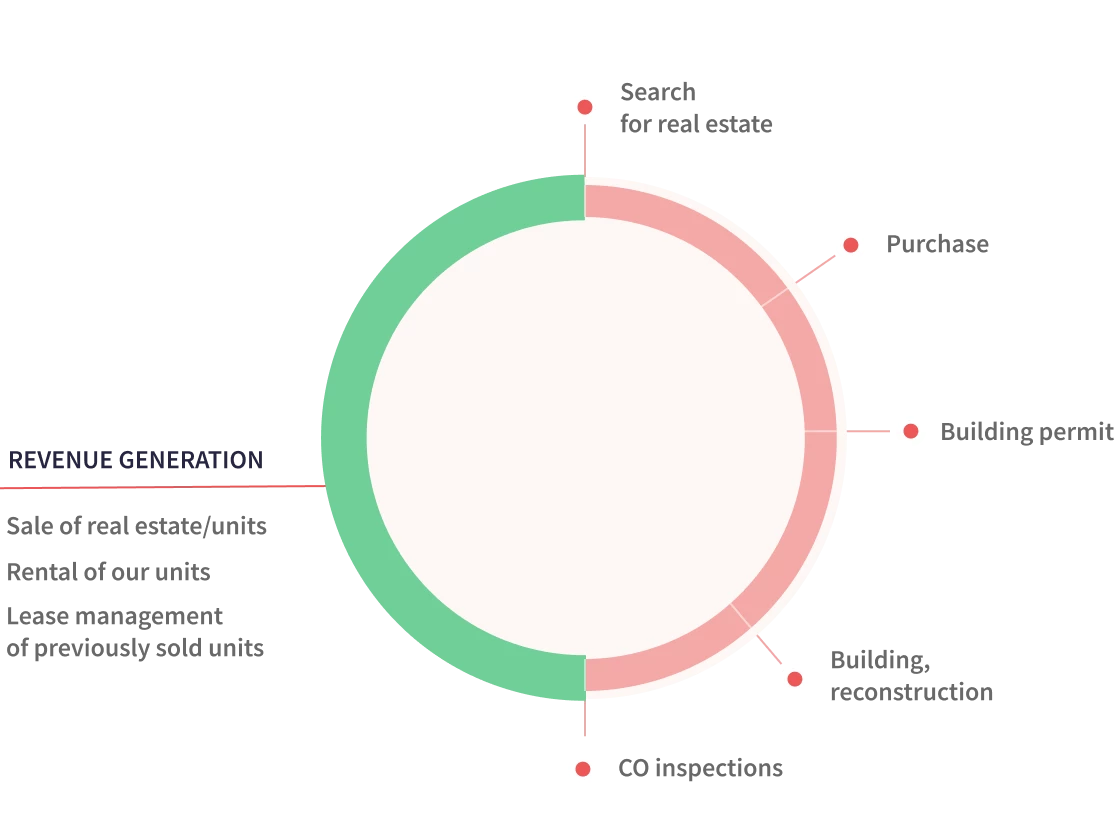

We are a team of professionals with many years of experience in the real estate market, which is why we control the entire investment cycle, thus increasing the efficiency of all processes and investments. It also constantly strengthens our knowledge of the market, allows us to react flexibly to its development and to always be one step ahead.

We supervise the whole process from the search for a suitable building for investments, through to purchase, building permits, realization of construction or reconstruction, obtaining the certificate of occupancy and subsequent administration of the property.

Investment cycle

Completed Projects

Avion Budějovická

Apartment complex in Krč.

Residence Strakonická

Residential units near the center of Prague. www.rezidencestrakonicka.cz

HONEST Smíchov

Stylish serviced apartments in Smíchov – www.honestprague.cz

Residence Vojanka

An elegant residential project in Košíře.